The balance sheet pattern of Indian households is unique compared to other countries. In India, household assets are skewed in favour of physical assets - 69% in real estate and 8% in gold. However, an economy's productive capacity is determined by aggregate stock of disposable income available for consumption purposes, which is relatively lower in India - as low as only 20% of wealth is concentrated in financial assets.

There is a sea change in how our investment habits have evolved in past couple of decades. Twenty years back, mutual fund was something to be flirted with after all modes or options for investing were exhausted. When we started earning, our parents told us to open a PPF account with the largest PSU bank. Nowadays when youngsters start earning, they open an SIP. But the Fun fact is - India's MF industry penetration is still amongst the lowest in the world. With the world allocating a large chunk to investments and retirement savings, it provides an opportunity for a long runway for the growth of financial products in India.

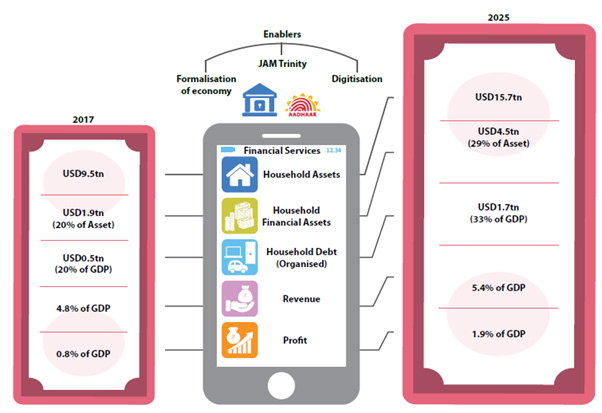

Financial sector revolution has just begun

Currently, in India, household debt is extremely low, and there is a lot of scope for it to rise. Government policies will only help it rise further. Massive drive towards financial inclusion – JAM trinity opening of accounts (Jan Dhan), credible identification mechanism (Aadhaar) and enabling transactions (mobile) – augurs well for the financial sector. This, along with a young population, is an indication of a big leverage cycle among households in India, something which was seen in the US in the 1980s.

A change is visible with Financialisation of savings

- Lower Cost: Since ETFs are passively managed, the expense ratios of ETFs are much lower than actively managed schemes. For the same scheme portfolio performance, a scheme with lower expense ratio will give higher returns than a scheme with higher expense ratio. This is the biggest advantage of ETFs.

- Exposure to market risk only: Since ETFs track the market index, they are exposed to market risk only. An actively managed mutual fund scheme, on the other hand, will be either overweight or underweight to certain stocks / sectors relative to the benchmark index. Therefore, they will have some unsystematic risk (risk over and above market risk) and may outperform or underperform market depending on specific market conditions. ETFs do not have any unsystematic risk.

- Efficient and safe way of investing in Gold: Gold is an important asset class for investors in India. Most Indian households buy gold in physical form, either as jewellery or bars / coins. Buying gold in physical form involves, making charge, cost of impurities (especially gold jewellery) and storage costs (e.g. bank locker charges). Gold ETFs are safe and efficient way of investing in Gold. Other benefits include no making charges, no impurities (price of pure 24 carat Gold) and high safety (paper form).

Disadvantages of ETFs

- Demat account required: Investors need a demat account for investing in ETFs. You can still invest in mutual funds even if you don’t have a demat account.

- Transactions takes place only on stock exchanges: ETF transactions (except NFO purchase) takes place on stock exchange through stockbrokers. Mutual fund investors can redeem (sell) their units partially or fully with the AMC however, in ETFs you can sell your ETF units only on the exchange. The liquidity of an ETF will depend on the volume of transactions that take place in the exchange.

- No excess returns: As discussed earlier, ETFs aim to replicate market returns. Actively managed MF scheme, on the other hand, aim to generate alpha – excess over market benchmark returns. Historical data shows that, over long investment tenors, actively managed schemes have outperformed ETFs in India.

- Mostly large cap in India: The vast majority of ETFs in India track large cap indices like Sensex, Nifty, BSE – 100, Nifty 100 etc. Midcaps and small caps can outperform large caps over long investment tenors. There are not many investment choices in midcaps and small caps as far as ETFs are concerned.

Points to consider when investing in ETF

- You should be very clear about your investment strategy when investing in ETFs. Currently, they have only a large cap orientation.

- Expense ratio and tracking errors (deviation from market benchmark returns) should be the two most important considerations when choosing ETFs. Select ETFs with low expense ratios and tracking errors.

- Since ETFs can be sold only on stock exchanges, liquidity should be an important factor while making ETF investments. Some ETFs (like Sensex and Nifty ETFs) have high trading volumes but not all ETFs have high liquidity.

- You need to have demat and trading accounts for investing in ETFs. There will be some costs involved with these accounts. However, these costs will be much lower compared to the expense ratio advantage of ETFs.

Conclusion

- As a market becomes more efficient like Dow Jones or Nasdaq in the US, it will become increasingly more difficult to generate alphas. Over a period of time, the performance differential between actively managed schemes and ETFs will reduce in India; cost will then play an important role in returns. ETFs are excellent low cost investment options and we expect ETFs to become more popular over time.

- Best performing actively managed mutual funds can beat ETFs in the long term, but many actively managed schemes also underperform in comparison to ETFs. In our view, you should have a mix of actively managed schemes and ETFs in your investment portfolio. The percentage allocations to each will depend on your risk appetite. You should consult your financial advisor.

- Gold ETFs are much more efficient and safe way of investing in Gold compared to the physical asset.

An investor education initiative by Edelweiss Mutual Fund

All Mutual Fund Investors have to go through a one-time KYC process. Investors should deal only with Registered Mutual Fund (RMF). For more info on KYC, RMF and procedure to lodge/redress any complaints, visit - https://www.edelweissmf.com/kyc-norms

MUTUAL FUND INVESTMENTS ARE SUBJECT TO MARKET RISKS. READ ALL SCHEME-RELATED DOCUMENTS CAREFULLY

Trending Articles

MUTUAL FUND INVESTMENTS ARE SUBJECT TO MARKET RISKS, READ ALL SCHEME RELATED DOCUMENTS CAREFULLY.