Edelweiss Overnight Fund

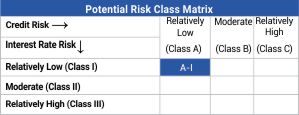

An open-ended debt scheme investing in overnight securities. A relatively low interest rate risk and relatively low credit risk.

Data as on 31st October, 2025

| Investment Objective : The investment objective of the scheme is to seek to generate returns commensurate with risk of investment in overnight instruments. However, there is no assurance that the investment objective of the Scheme will be realized and the Scheme does not assurance or guarantee any returns. |

|

| Inception Date | 24-Jul-19 |

| Benchmark | CRISIL Liquid Overnight Index |

| Fund Managers Details | Ms. Pranavi Kulkarni Managing Since 17 years Managing Since 23-Nov-21 Mr. Hetul Raval Managing Since 8 years Managing Since 01-Jul-24 |

| Minimum Investment Amount | Rs. 100/- per application & in multiples of Re. 1/- thereafter. |

| Additional investment amount | Rs. 100/- per application & in multiples of Re. 1/- thereafter |

| Exit Load | Nil |

| Total Expense Ratios~: | Regular Plan 0.16% Direct Plan 0.11% |

| Month End AUM |

Rs. 157.71 Crore

|

| Monthly Average AUM |

Rs. 229.59 Crore

|

|

Direct Plan Daily IDCW Option

|

1000.1687

|

|

Direct Plan - Growth

|

1364.0977

|

|

Direct Plan - IDCW Monthly

|

1058.4527

|

|

Direct Plan Annual IDCW Option

|

1364.5602

|

Regular Plan - IDCW - Fortnightly |

1095.6227 |

|

Regular Plan IDCW - Daily

|

1008.3499

|

|

Regular Plan Growth Option

|

1359.3778

|

|

Regular Plan IDCW Weekly

|

1016.9753

|

|

Regular Plan IDCW Monthly

|

1005.3014

|

|

Regular Plan IDCW Annual

|

1359.3838

|

| ( as on October 31, 2025) |

|

Period

|

Scheme - Regular Plan |

Benchmark CRISIL Liquid Overnight Index** |

Additional Benchmark (CRISIL 1 year T-bill Index) |

|||

|

Returns |

Value of Rs. 10000 Invested |

Returns |

Value of Rs. 10000 Invested |

Returns |

Value of Rs. 10000 Invested |

|

| Last 7 days | 5.37% |

10,010 |

5.50% |

10,011 |

1.95% |

10,004 |

| Last 15 days | 5.34% |

10,022 |

5.48% |

10,023 |

3.34% |

10,014 |

| Last 30 days | 5.38% |

10,046 |

5.42% |

10,046 |

4.39% |

10,037 |

| Last 1 Year | 5.92% |

10,592 |

6.04% |

10,604 |

6.65% |

10,665 |

| Last 3 Years | 6.34% |

12,026 |

6.48% |

12,073 |

7.07% |

12,275 |

| Last 5 Years | 5.23% |

12,904 |

5.38% |

12,999 |

5.61% |

13,138 |

| Since Inception | 5.01% |

13,594 |

5.12% |

13,679 |

5.80% |

14,246 |

Past performance may or may not be sustained in future and

should not be used as a basis for comparison with other investments.

‘Returns are simple annualized for 1 year and below and compounded annualized for above 1 year.’

Notes:

1. Different plans shall have different expense structure. The performance details provided herein are of Regular Plan of Edelweiss Overnight Fund. Returns are for Growth Option only. Since Inception

returns are calculated on Rs. 1000/- invested at inception of the scheme. In case the start/end date is non business day, the NAV of previous day is used for computation.

2. The scheme is currently managed by Pranavi Kulkarni (managing this fund from November 23, 2021) and Hetul Raval (managing this fund from July 01, 2024). Please for name of the other schemes currently managed by the Fund Managers and relevant scheme for performance. Please Click here for name of the other schemes

currently managed by the Fund Managers and relevant scheme for performance.

3. ‘Returns are simple annualized for 1 year and below and compounded annualized for above 1

year.’

4. **With effect from 12th March 2024, the benchmark for Edelweiss Overnight Fund has been changed from NIFTY 1D Rate Index to CRISIL Liquid Overnight Index (Tier 1 Benchmark)

For performance of Direct Plan please

click here

|

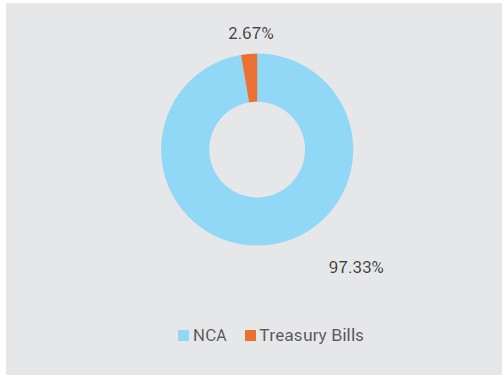

Name of Instrument

|

Ratings

|

% to Net Assets

|

| Cash & Other Receivables | 100.00% | |

| TREPS_RED_03.11.2025 | 99.71% | |

| Cash & Cash Equivalent | 0.29% | |

| Grand Total | 100.00% |

|

Yield to maturity (YTM)

|

5.64%

|

|

Modified Duration

|

3.00 Day

|

|

Average Maturity

|

3.00 Day

|

|

Macaulay Duration

|

3.17 Day

|

This Product is suitable for investors who are seeking*:

- To generate short term optimal returns in line with overnight rates and high liquidity

- To invest in money market and debt instrument with maturity of 1 day

*Investors should consult their financial advisers if in doubt about whether the product is suitable for them.

Benchmark Riskometer: CRISIL Liquid Overnight Index