Edelweiss Nifty500 Multicap Momentum Quality 50 ETF

(An open-ended exchange traded scheme replicating/tracking Nifty500 Multicap Momentum Quality 50 Total Return Index.)

Data as on 31st October, 2025

| Investment Objective : The investment objective of the scheme is to generate returns that are in line with the performance of the Nifty500 Multicap Momentum Quality 50 Total Return Index, subject to tracking errors. There is no assurance or guarantee that the investment objective of the Scheme will be achieved. |

|

| Inception Date | 31-Oct-24 |

| Benchmark | Nifty500 Multicap Momentum Quality 50 TRI |

| Fund Managers Details | Mr. Bhavesh Jain Experience 17 years Managing Since 31-Oct-24 |

| Creation Unit Size | 25,000 |

| Minimum Investment Amount | Through the stock exchange - 1 unit & in multiplies thereof. Directly with the Mutual Fund - in creation unit size i.e., 25,000 units & in multiplies thereof. |

| Exit Load | Nil |

| Total Expense Ratios~: | 0.31% |

| Tracking Error: | Direct: 0.47% |

| Month End AUM |

Rs. 31.94 Crore

|

| Monthly Average AUM | Rs. 32.79 Crore |

Regular Plan - Growth |

42.6329 |

| (as on October 31, 2025) |

|

Name of Instrument

|

Industry

|

% to Net Assets

|

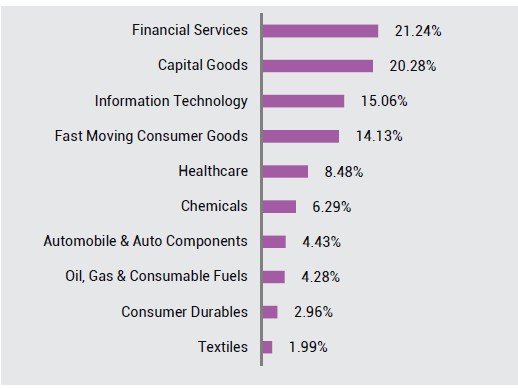

| Equities | 99.88% | |

| EICHER MOTORS LTD | Automobile & Auto Components | 5.71% |

| BAJAJ FINANCE LTD | Financial Services | 5.69% |

| NESTLE INDIA LTD | Fast Moving Consumer Goods | 5.35% |

| BHARAT ELECTRONICS LTD | Capital Goods | 5.31% |

| DIVI'S LABORATORIES LTD | Healthcare | 5.17% |

| BRITANNIA INDUSTRIES LTD | Fast Moving Consumer Goods | 4.89% |

| HCL TECHNOLOGIES LTD | Information Technology | 4.54% |

| BSE LTD | Financial Services | 4.50% |

| SUZLON ENERGY LTD | Capital Goods | 4.38% |

| HINDUSTAN AERONAUTICS LIMITED | Capital Goods | 4.32% |

| PERSISTENT SYSTEMS LTD | Information Technology | 3.82% |

| COFORGE LIMITED | Information Technology | 3.79% |

| BHARAT PETROLEUM CORPORATION LTD | Oil, Gas & Consumable Fuels | 3.60% |

| HDFC ASSET MANAGEMENT COMPANY LIMITED | Financial Services | 3.38% |

| DIXON TECHNOLOGIES (INDIA) LTD | Consumer Durables | 3.17% |

| SOLAR INDUSTRIES INDIA LTD | Chemicals | 3.11% |

| MARICO LTD | Fast Moving Consumer Goods | 2.53% |

| CG POWER AND INDUSTRIAL SOLUTIONS LTD | Capital Goods | 2.20% |

| COROMANDEL INTERNATIONAL LTD | Chemicals | 2.20% |

| MAZAGON DOCK SHIPBUILDERS LTD. | Capital Goods | 1.70% |

| PAGE INDUSTRIES LTD | Textiles | 1.69% |

| CENTRAL DEPOSITORY SERVICES (I) LTD | Financial Services | 1.56% |

| MANAPPURAM FINANCE LTD | Financial Services | 1.19% |

| 360 ONE WAM LIMITED | Financial Services | 1.07% |

| NARAYANA HRUDAYALAYA LTD | Healthcare | 1.04% |

| GODFREY PHILLIPS INDIA LTD | Fast Moving Consumer Goods | 1.01% |

| COMPUTER AGE MANAGEMENT SERVICES LTD. | Financial Services | 0.95% |

| NIPPON LIFE INDIA ASSET MGMT LTD | Financial Services | 0.86% |

| GLAXOSMITHKLINE PHARMACEUTICALS LTD | Healthcare | 0.82% |

| INTELLECT DESIGN ARENA LTD | Information Technology | 0.80% |

| MOTILAL OSWAL FINANCIAL SERVICES LTD | Financial Services | 0.79% |

| AFFLE 3I LIMITED | Information Technology | 0.75% |

| ANGEL ONE LIMITED | Financial Services | 0.75% |

| INDIAN ENERGY EXCHANGE LTD | Financial Services | 0.73% |

| GARDEN REACH SHIPBUILDERS & ENGINEERS | Capital Goods | 0.67% |

| ECLERX SERVICES LTD | Services | 0.63% |

| CASTROL (INDIA) LTD | Oil, Gas & Consumable Fuels | 0.56% |

| ZENSAR TECHNOLGIES LTD | Information Technology | 0.53% |

| COHANCE LIFESCIENCES LIMITED | Healthcare | 0.49% |

| GILLETTE INDIA LTD | Fast Moving Consumer Goods | 0.46% |

| ZEN TECHNOLOGIES LTD | Capital Goods | 0.46% |

| LT FOODS LTD | Fast Moving Consumer Goods | 0.42% |

| MAHANAGAR GAS LTD | Oil, Gas & Consumable Fuels | 0.39% |

| ASTRAZENCA PHARMA INDIA LTD | Healthcare | 0.37% |

| NEWGEN SOFTWARE TECHNOLOGIES LTD | Information Technology | 0.33% |

| ELECON ENGINEERING CO.LTD. | Capital Goods | 0.27% |

| SCHNEIDER ELECTRIC INFRASTRUCTURE LTD | Capital Goods | 0.27% |

| CAPLIN POINT LABORATORIES LTD | Healthcare | 0.24% |

| BLS INTERNATIONAL SERVICES LTD. | Consumer Services | 0.22% |

| ACTION CONSTRUCTION EQUIPMENT LTD | Capital Goods | 0.20% |

| Cash & Other Receivables | 0.12% | |

| Cash & Cash Equivalent | 0.12% | |

| Grand Total | 100.00% |

|

Period

|

Scheme-Edelweiss Nifty 500 Multicap Momentum Quality 50 ETF |

Benchmark (Nifty500 Multicap Momentum Quality 50 TR Index) |

Additional Benchmark (Nifty 50 TR Index) |

|||

|

Returns |

Value of Rs. 10000 Invested |

Returns |

Value of Rs. 10000 Invested |

Returns |

Value of Rs. 10000 Invested |

|

|

1 Year |

-6.28% |

9,372 |

-5.89% |

9,411 |

7.59% |

10,759 |

|

Since Inception - Regular Plan |

-6.28% |

9,372 |

-5.89% |

9,411 |

7.59% |

10,759 |

Past performance may or may not be sustained in future and

should not be used as a basis for comparison with other investments.

Notes:

1.The scheme is currently managed by Bhavesh Jain (managing this fund from October 31, 2024). Please Click here

for name of the

other schemes currently managed by the Fund Managers and relevant scheme for performance.

2. Tracking error is annualised and is calculated based on past one year data.

3. For performance of Direct Plan please refer

This Product is suitable for investors who are seeking*:

- Long term capital appreciation

- Returns that are in line with the performance of the Nifty500 Multicap Momentum Quality 50 Total Return Index, subject to tracking errors.

*Investors should consult their financial advisers if in doubt about whether the product is suitable for them.

Benchmark Riskometer: Nifty500 Multicap Momentum Quality 50 TRI