Edelweiss Asean Equity Off-Shore Fund

An open ended fund of fund scheme investing in JPMorgan Funds – ASEAN Equity Fund

Data as on 31st October, 2025

| Investment Objective : The primary investment objective of the Scheme is to provide long term capital growth by investing predominantly in JPMorgan Funds – ASEAN Equity Fund, an equity fund which invests primarily in companies of countries which are members of the Association of South East Asian Nations (ASEAN). However, there can be no assurance that the investment objective of the Scheme will be realized. |

|

| Inception Date | 1-Jul-11 |

| Benchmark | MSCI AC ASEAN 10/40 Index** |

| Fund Managers Details | Mr. Bhavesh Jain Experience 17 years Managing Since 27-Sep-2019 Mr. Bharat Lahoti Experience 18 years Managing Since 01-Oct-2021 |

| Minimum Investment Amount | Rs. 100/- per application & in multiples of Re. 1/- thereof |

| Additional Investment Amount | Rs. 100/- per application & in multiples of Re. 1/- thereof |

| Exit Load |

|

| Total Expense Ratios~: | Regular Plan 2.38% Direct Plan 1.66% This includes expense of underlying fund Expense of underlying fund - 0.91% |

| Month End AUM |

Rs. 131.49 Crore

|

| Monthly Average AUM |

Rs. 130.25 Crore

|

| Direct Plan Growth Option |

31.7230

|

| Regular Plan Growth Option |

35.4840

|

| (as on October 31, 2025) |

|

Name of Instrument

|

Exposure

|

| DBS Group Holdings Ltd | 10.05% |

| Sea Limited Sponsored ADR Class A | 9.48% |

| PT Bank Central Asia Tbk | 5.76% |

| United Overseas Bank Limited | 4.45% |

| Oversea-Chinese Banking Corporation Limited | 4.14% |

| Singapore Telecommunications Limited | 3.24% |

| PT Bank Rakyat Indonesia (Persero) Tbk Class B | 2.92% |

| Grab Holdings Limited Class A | 2.77% |

| CapitaLand Integrated Commercial Trust | 2.68% |

| Singapore Exchange Ltd. | 2.62% |

| Delta Electronics (Thailand) Public Co. Ltd.(Alien Mkt) | 2.30% |

| Gamuda Bhd. | 2.22% |

| PT Telkom Indonesia (Persero) Tbk Class B | 2.20% |

| PTT Public Co., Ltd.(Alien Mkt) | 2.06% |

| Advanced Info Service Public Co., Ltd.(Alien Mkt) | 1.94% |

| Singapore Technologies Engineering Ltd | 1.93% |

| CP ALL Public Company Limited(Alien Mkt) | 1.89% |

| Gulf Development Public Company Limited(Alien Mkt) | 1.82% |

| International Container Terminal Services, Inc. | 1.75% |

| Bumrungrad Hospital Public Co., Ltd.(Alien Mkt) | 1.65% |

| BDO Unibank, Inc. | 1.61% |

| CIMB Group Holdings Bhd | 1.55% |

| Keppel Ltd. | 1.52% |

| Central Pattana Public Co. Ltd.(Alien Mkt) | 1.37% |

| Jardine Cycle & Carriage Limited | 1.32% |

| Tenaga Nasional Bhd | 1.22% |

| Minor International Public Co., Ltd.(Alien Mkt) | 1.15% |

| Bank of the Philippine Islands | 1.15% |

| PT Bank Mandiri (Persero) Tbk | 1.01% |

| Malayan Banking Bhd. | 1.00% |

| Grand Total | 80.79% |

| Others | 19.21% |

JPMorgan Funds – ASEAN Equity Fund as on 30th September, 2025

|

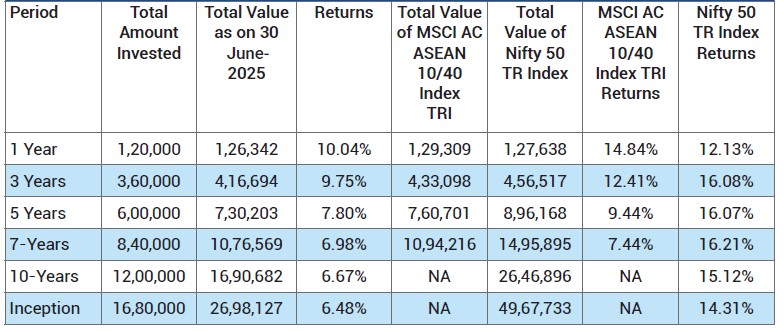

Period

|

Scheme - Regular Plan |

Benchmark MSCI AC ASEAN 10/40 Index**#) |

Additional Benchmark (Nifty 50 TR Index) |

|||

|

Returns* |

Value of Rs. 10000 Invested |

Returns* |

Value of Rs. 10000 Invested |

Returns* |

Value of Rs. 10000 Invested |

|

|

1 Year |

14.25% |

11,429 |

18.64% |

11,869 |

6.99% |

10,701 |

|

3 Year |

11.88% |

14,008 |

14.21% |

14,904 |

13.90% |

14,781 |

| 5 Year | 11.74% |

17,430 |

11.93% |

17,581 |

18.56% |

23,449 |

|

10 Year |

8.00% |

21,598 |

NA |

NA |

13.67% |

36,060 |

|

Since Inception - Edelweiss Asean Equity Off-Shore Fund |

8.38% |

31,723 |

NA |

NA |

12.54% |

54,446 |

Past performance may or may not be sustained in future and

should not be used as a basis for

comparison with other investments. * CAGR Return.

Notes:

1. **The Benchmark Index of Edelweiss ASEAN Equity Off-shore Fund has been changed to MSCI AC ASEAN 10/40 Index (Total Return Net) with effect from December 1, 2021 in line

with the framework issued by AMFI for Tier 1 benchmarks:

2. Different plans shall have different expense structure. The performance details provided here in are

of Regular Plan of Edelweiss Asean Equity Off-Shore Fund. Returns are for Growth Option only. Since

Inception returns are calculated on Rs. 10/- invested at inception of the scheme. In case the

start/end date is non business day, the NAV of previous day is used for computation.

3. The scheme is currently managed by Mr. Bhavesh Jain (Managing this fund from September 27, 2019) &

Mr. Bharat Lahoti (Managing this fund from October 01, 2021).

Please Click here for name of the other

schemes currently managed by the Fund Managers and relevant scheme for performance.

4. Please note that the scheme is acquired from JPMorgan mutual fund on

and from the close of

business hours of November 25, 2016, hence disclosure requirement vide SEBI Circular no.

SEBI/HO/IMD/DF3/CIR/P/2018/69 dated April 12, 2018 on performance disclosure post consolidation/

Merger of Schemes, prior to acquisition date, is not provided.

5. #Please note that benchmark of the Scheme is changed from MSCI South East Asia Index to MSCI AC

ASEAN Index

6. Investors in the scheme shall bear the recurring expenses of the scheme in addition to the expenses of other schemes in which this fund of funds scheme makes investment

(subject to regulatory limits).

For performance of Direct Plan please

click here

This Product is suitable for investors who are seeking*:

- Long term capital growth

- Investments predominantly in JPMorgan Funds - ASEAN Equity Fund, an equity fund which invests primarily in companies of countries which are members of the Association of South East Asian Nations

*Investors should consult their financial advisers if in doubt about whether the product is suitable for them.

Benchmark Riskometer: MSCI AC ASEAN 10/40 Index**