Edelweiss Technology Fund

(An open-ended equity scheme investing in technology & technology-related companies)

Data as on 31st October, 2025

| Investment Objective : To provide long-term capital appreciation by investing predominantly in equity and equity-related securities of technology & technologyrelated companies.However, there is no assurance that the investment objective of the Scheme will be realized and the Scheme does not assure or guarantee any returns. |

|

| Inception Date | 05-Mar-24 |

| Benchmark* | BSE TECK TRI *With effect from June 1, 2024, S&P BSE TECk TRI has been renamed to BSE Teck TRI. |

| Fund Managers Details | Mr. Sumanta Khan Experience 18 years Managing Since 01-Apr-24 Mr. Trideep Bhattacharya Experience 25 years Managing Since 05-Mar-24 Mr. Raj Koradia Experience 7 years Managing Since 01-Aug-24 Overseas Securities: Mr. Amit Vora Experience 16 years Managing Since 05-Mar-24 |

| Minimum Investment amount | Rs. 100/- per application & in multiples of Re. 1/- thereafter. |

| Additional investment amount | Rs. 100/- per application & in multiples of Re. 1/- thereafter. |

| Exit Load |

|

| Total Expense Ratios~: | Regular Plan 2.29% Direct Plan 0.59% |

| Month End AUM |

Rs. 724.21 Crore

|

| Monthly Average AUM |

Rs. 707.38 Crore

|

| Regular Plan Growth Option |

12.2589 |

| Regular Plan IDCW Option |

12.2589

|

| Direct Plan Growth Option | 12.6166 |

| Direct Plan IDCW Option |

12.6166

|

| ( as on October 31, 2025) |

|

Name of Instrument

|

Industry

|

% to Net

Assets

|

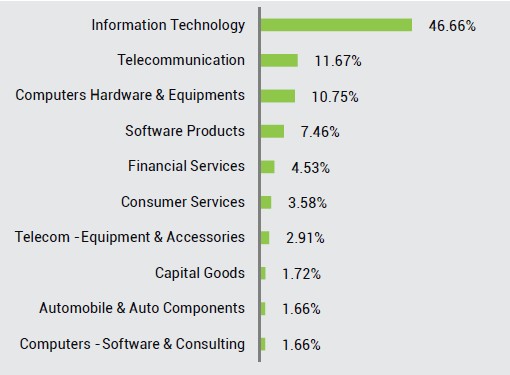

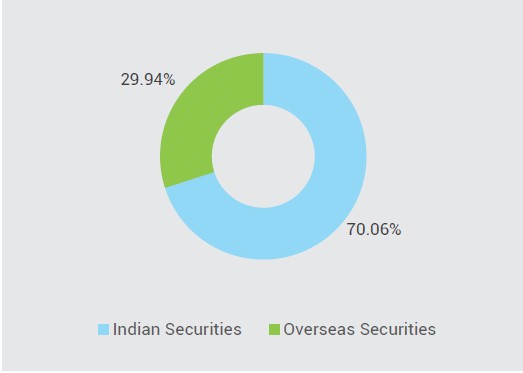

| Equities | 96.45% | |

| Bharti Airtel Ltd. | Telecommunication | 10.73% |

| Infosys Ltd. | Information Technology | 8.27% |

| NVIDIA CORP | Information Technology | 6.67% |

| APPLE INC | Software Products | 5.54% |

| MICROSOFT CORP | Computers Hardware & Equipments | 5.38% |

| Tech Mahindra Ltd. | Information Technology | 5.11% |

| HCL Technologies Ltd. | Information Technology | 4.78% |

| LTIMindtree Ltd. | Information Technology | 3.90% |

| Mphasis Ltd. | Information Technology | 3.73% |

| Eternal Ltd. | Consumer Services | 3.69% |

| Persistent Systems Ltd. | Information Technology | 3.54% |

| PB Fintech Ltd. | Financial Services | 2.67% |

| Coforge Ltd. | Information Technology | 2.39% |

| BROADCOM INC | Telecom - Equipment & Accessories | 2.37% |

| Zensar Technologies Ltd. | Information Technology | 2.17% |

| Tata Consultancy Services Ltd. | Information Technology | 2.14% |

| Dixon Technologies (India) Ltd. | Consumer Durables | 1.52% |

| JSW Energy Ltd. | Power | 1.51% |

| Home First Finance Company India Ltd. | Financial Services | 1.37% |

| Larsen & Toubro Ltd. | Construction | 1.26% |

| Cyient Ltd. | Information Technology | 1.15% |

| Teamlease Services Ltd. | Services | 1.07% |

| Data Patterns (India) Ltd. | Capital Goods | 1.00% |

| Birlasoft Ltd. | Information Technology | 0.99% |

| Kaynes Technology India Ltd. | Capital Goods | 0.89% |

| Sona BLW Precision Forgings Ltd. | Automobile & Auto Components | 0.85% |

| Oracle Financial Services Software Ltd. | Information Technology | 0.79% |

| TBO Tek Ltd. | Consumer Services | 0.68% |

| Netweb Technologies India Ltd. | Information Technology | 0.66% |

| KPIT Technologies Ltd. | Information Technology | 0.62% |

| PALANTIR TECHNOLOGIES INC | Computers Hardware & Equipments | 0.60% |

| ORACLE CORPORATION | Computers Hardware & Equipments | 0.59% |

| ADVANCED MICRO DEVICES INC | Software Products | 0.58% |

| ABB India Ltd. | Capital Goods | 0.49% |

| IBM | Computers - Software & Consulting | 0.39% |

| CISCO SYSTEMS INC | Telecom - Equipment & Accessories | 0.37% |

| MICRON TECHNOLOGY INC | Computers Hardware & Equipments | 0.35% |

| SALESFORCE INC | Computers Hardware & Equipments | 0.33% |

| LAM RESEARCH CORPORATION | Computers Hardware & Equipments | 0.28% |

| QUALCOMM INC | Computers Hardware & Equipments | 0.28% |

| APPLIED MATERIALS INC | Software Products | 0.27% |

| SERVICENOW INC. | Computers - Software & Consulting | 0.26% |

| INTUIT INC | Computers - Software & Consulting | 0.25% |

| INTEL CORP | Computers - Software & Consulting | 0.24% |

| KLA CORP | Computers Hardware & Equipments | 0.23% |

| AMPHENOL CORP | Software Products | 0.23% |

| ACCENTURE PLC | Software Products | 0.22% |

| ARISTA NETWORKS INC. | Software Products | 0.22% |

| ADOBE INC | Software Products | 0.21% |

| TEXAS INSTRUMENTS INC | Computers Hardware & Equipments | 0.21% |

| Tata Motors Passenger Vehicles Ltd. | Automobile & Auto Components | 0.20% |

| PALO ALTO NETWORKS INC | Computers Hardware & Equipments | 0.20% |

| CROWDSTRIKE HOLDINGS INC | Computers Hardware & Equipments | 0.18% |

| ANALOG DEVICES INC | Software Products | 0.16% |

| DELL TECHNOLOGIES INC | Software Products | 0.15% |

| CADENCE DESIGN SYS INC | Telecom - Equipment & Accessories | 0.13% |

| TML Commercial Vehicles Ltd. | Capital Goods | 0.13% |

| SYNOPSYS INC | Computers - Software & Consulting | 0.12% |

| TE CONNECTIVITY PLC | Computers - Software & Consulting | 0.10% |

| CORNING INC | Computers Hardware & Equipments | 0.10% |

| AUTODESK INC | Software Products | 0.09% |

| MOTOROLA SOLUTIONS INC | Computers Hardware & Equipments | 0.09% |

| FORTINET INC | Computers Hardware & Equipments | 0.08% |

| NXP SEMICONDUCTORS NV | Computers Hardware & Equipments | 0.07% |

| MONOLITHIC POWER SYSTEM INC | Computers Hardware & Equipments | 0.07% |

| ROPER TECHNOLOGIES INC | Computers Hardware & Equipments | 0.07% |

| FAIR ISAAC CORP | Computers Hardware & Equipments | 0.06% |

| COGNIZANT TECH SOLUTIONS | Telecom - Equipment & Accessories | 0.05% |

| MICROCHIP TECHNOLOGY INC | Computers Hardware & Equipments | 0.05% |

| FIRST SOLAR INC | Computers Hardware & Equipments | 0.04% |

| HP INC | Computers - Software & Consulting | 0.04% |

| KEYSIGHT TECHNOLOGIES INC | Computers Hardware & Equipments | 0.04% |

| HEWLETT PACKARD ENTERPRISE CO | IT Enabled Services | 0.04% |

| CDW CORP/DE | Telecom - Equipment & Accessories | 0.03% |

| NETAPP INC | Computers Hardware & Equipments | 0.03% |

| TYLER TECHNOLOGIES INC. | Computers Hardware & Equipments | 0.03% |

| GARTNER INC | Computers Hardware & Equipments | 0.03% |

| ON SEMICONDUCTOR CORPORATION | Computers Hardware & Equipments | 0.03% |

| Cash & Other Receivables | 3.55% | |

| TREPS_RED_03.11.2025 | 3.58% | |

| Cash & Cash Equivalent | -0.03% | |

| Grand Total | 100.00% |

|

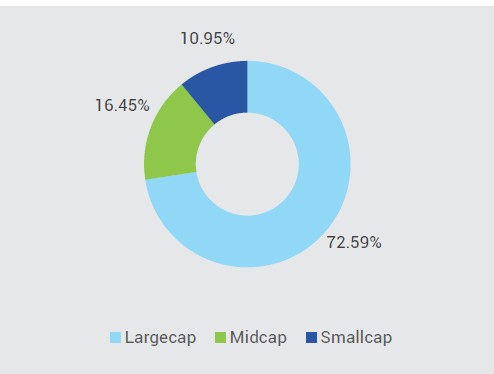

Total stocks

in portfolio |

78 |

|

Active

Share |

73.64% |

|

Top 10 stocks |

57.80% |

|

Net Equity |

96.40% |

| Portfolio Turnover Ratio^ | Equity 0.08 F&O 0.00 |

| Total Portfolio Turnover Ratio^ | 0.08 |

| Active share is the fraction of a fund’s portfolio holdings that deviate from the benchmark index. Source: Bloomberg. ^Lower of sales or purchase divided by average AUM for last rolling 12 months. |

|

|

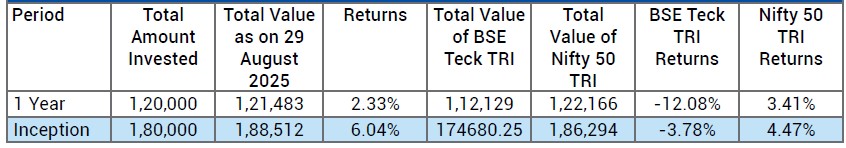

Period

|

Scheme - Regular Plan |

Benchmark (BSE Teck TR Index) |

Additional Benchmark (Nifty 50 TR Index) |

|||

|

Returns* |

Value of Rs. 10000 Invested |

Returns* |

Value of Rs. 10000 Invested |

Returns* |

Value of Rs. 10000 Invested |

|

|

1 Year |

5.91% |

10,591 |

-3.65% |

9,635 |

7.59% |

10,759 |

|

Since Inception - Regular Plan |

13.07% |

12,259 |

5.50% |

10,929 |

10.27% |

11,760 |

Notes:

1. The scheme is currently managed by Mr. Sumanta Khan (managing this fund from April 01, 2024). & Mr Trideep Bhattacharya (managing this fund from March 05, 2024). & Mr. Raj Koradia (managing this fund from August 01, 2024). & Overseas Fund Manager: Mr. Amit Vora (managing this fund from March 05, 2024)

name of the other schemes currently managed by the Fund Managers and relevant scheme for performance

2. *With effect from June 1, 2024, S&P BSE TECk TRI has been renamed to BSE Teck TRI.

This Product is suitable for investors who are seeking*:

- Long term capital appreciation

- Investment in equity and equity related instruments of technology and technology related companies.

*Investors should consult their financial advisers if in doubt about whether the product is suitable for them.

Benchmark Riskometer: BSE TECK TRI